Each week I will cover 1 of the 11 propositions that will be on the California Ballot in November. Are you ready? Let’s go!

Proposition 30

TDL summary

The state would like people who make more than $250 G per year to pay more in taxes to help us pay for California education. Our state is in a deficit. Folks are broke and we aren’t bringing in enough revenue via state income tax. Houses are being foreclosed, so not enough money is coming in from property tax. We don’t have enough money to cover our debt, and bringing the debt down is muy importante. Being in debt is just plain embarrassing!

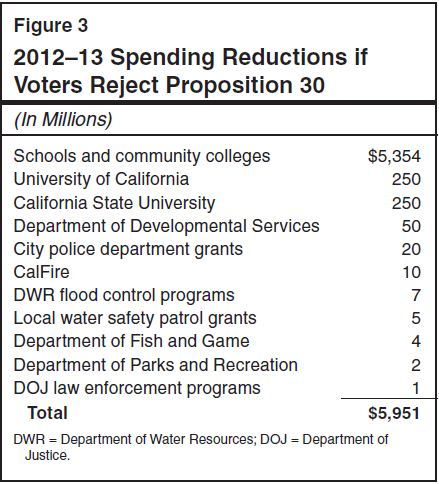

If the measure doesn’t pass, the Governor is just going to have to keep on making cuts in Education. He passed this years (2012) budget assuming that we will pass Prop. 30. If we don’t pass Prop 30, tuition for community colleges and universities are going to increase. Cuts to child care programs and subsidies supporting parents who need to work are going to continue being slashed. Oh and K-14 education in California would really suck (schools could reduce the school year in order to save money and reduce enrollment into community college).

He will also cut funding for City Police Departments (no more Oakland Police funding!!), CAL Fire Departments (wild fires going crazy!), Department of Parks and Recreation (entrance fee to the Redwoods!!) and Department of Fish and Game (*wallslides*).

If Prop 30 does not pass, Brown will make (around) 6 Billion Dollars in cuts!

So tax the rich. What does that mean?

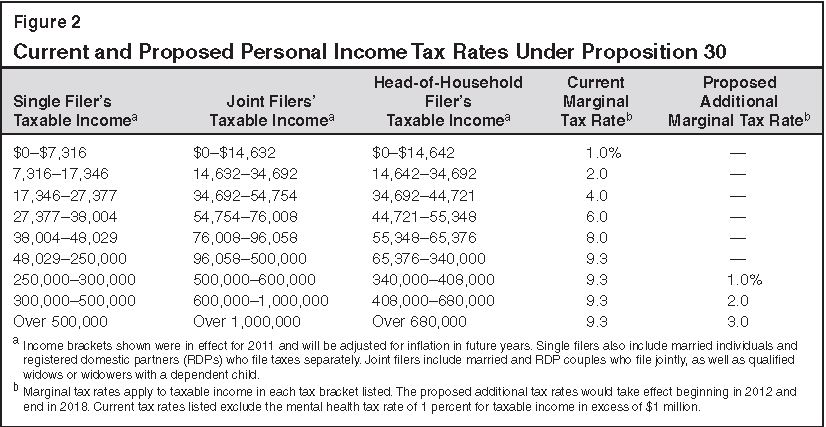

Those who have higher incomes ($48 G and up) have a current PIT (personal income tax) marginal rate of 9.3%. If this measure passes, as your income goes up the marginal tax rate will increase by 1%.

Let say you are single and you make between $250 – $300G a year. Your new marginal tax rate would be 9.3% +1 = 10.3%.

$300- 500G a year? = 11.3%

Over $500G? = 12.3%

For those with dual income the increase starts with $500 – 600G (10.3%), $600 – 1M (11.3%) and $1M and up (12.3%)

Click on the handy dandy chart above for details.

OH By the way…

Prop 30 will also increase our sales tax by adding a 1/4 cent for every dollar.

What is 1/4 of a cent sales tax increase anyway?

Take a $20 dress.

What we would pay now: $20 x .825% (current Bay Area sales tax) = $21.65

1/4 of a cent for every dollar = $20 x .025 = $.50

New (after Prop 30) total = $22.15

(Please correct my math if it’s wrong. I failed everything math related.. …already corrected today..keep it coming!! )

Wait that’s not all!!

There are some provisions concerning some public safety programs that were transferred to local governments by the state. What programs?

- Incarcerating certain adult offenders. (Certain who? .. what?)

- Supervising parolees

- Providing substance abuse treatment services.

The new provisions will now stipulate that…

- The state will continue to provide funds to local governments to control these programs.

- If the state decides to add a new law concerning the program above, local governments would not have to implement the new law, unless the state gives them more money

- REQUIRES the state to add more money in case of unintentional costs.

- Sometimes the state puts “mandates” local governments to do things..ie take responsibility of programs..and the law would require the state to pay for those mandates. This provision would eliminate state responsibility to pay for those mandates. (RED FLAG – merely because I’m confused..so the state will continue to pay, but they don’t have to pay? *head scratcher*)

- The Brown Act requires that all local legislative meetings be open to the public. In the past the state would pay for some of the costs of this transparency, like posting agenda’s or minutes to the meetings. With this provision the state would not have to pay for that. (RED FLAG #2 – wait, so if the state doesn’t pay, will local govt be required to maintain transparency?)

PROS:

This initiative will increase our revenues by $6 BILLION dollars every year from now until 2016! It will prevent Governor Brown from making further cuts to our education, police and fire departments. More importantly..no more cuts to Fish and Game!!

Wooo Hoooo!! *Dances across the room in pjs!*

No more increase in Community College Tuition!!

No more cuts to Fish and Gaming!!! (..wait. I don’t eat fish. ..sit’s back down..)

CONS:

This is just going to make rich folks and some local policy wonks UPset.

“We are going to take our business elsewhere!”

“I’m movin’ to (insert low tax rate state) where they care about me keeping my money!”

“Hey..local city governments SHOULD tell us what they are doing and the state should pay for it! ..I’m outta here!”

I made those up.

The main arguments against this proposition are as follows:

1. No guarantee that this money will be used for schools. The California School Boards Association said: “The Governor’s initiative does not provide new funding for schools”. Which is technically true. It just prevents the governor from making further cuts.

2. This does not help cut waste, eliminate bureaucracy or cut admin overhead.

You can find more detailed and colorful comments against this proposition here:

California Proposition 30, Sales and Income Tax Increase (2012)

So in short:

Hey rich Calfornians, give us more $$! Let’s agree to pay a 1/4 of a cent per dollar in sales tax. AND let’s muddy the waters a little in what the state and local governments are responsible for and how they are paid for in terms of certain public safety programs. No one pays attention to that stuff anyway.

So in long:

..This post is already long enough. download the proposition here.

( Proposition 30 Summary Analysis.pdf This is 13 pages long. Good luck!)

——-

S0 what do you think? Is this proposition all good? Or is there some bad? Discuss! (Oh and if you can explain some unexplainables..let a sista know!)

4 responses to “California Proposition #30”

Your math is very wrong. (Watch your decimal points.)

A 1/4-cent sales tax increase is significant, especially on lower-income Californians that cannot afford it, and especially when you consider it on all purchases over the course of a week or month or year.

Using your example of the $20 dress:

If your current tax is 8.25% (or 0.0825), then the dress would cost $21.65.

An additional 1/4 of a penny — 2.5% (or 0.025) — adds 50 cents so that the dress now costs $22.15.

And besides, why do Sacramento politicians need more of our hard-earned money when they’re already hiding, I mean misplacing $54 million in the Parks Department and spending record amounts of money (according to the Sacramento Bee: http://www.sacbee.com/2012/08/18/4736652/californias-general-fund-spending.html)???

Looks like a lot of people need refresher courses in basic math.

Like me!! Lol

1/4 cent per dollar = 0.01 * 0.25 = 0.0025

so on a $20 dress you would owe an additional $20 * 0.0025 = 0.05

that’s just an extra nickel

Until the legislature has the courage to unchain itself from the teacher-union bosses, I urge everyone to vote against Prop. 30. In which other job sector can employees work a mere 180 days a year, make over $100K (in my district) and retire at an early age with a whopping annual pension of $100k for the rest of their lives? We need to set caps on such outlandish benefits before we raise taxes.